When the pandemic struck, the general reaction from the lead generation (LG) world was that it would be a short-term hindrance and the stereotypical approach to LG for FDI wouldn’t have to change much as a result. How wrong we all were.

Roll on two years and there has been dramatic changes across the industry when it comes to standard practice and what is required to successfully facilitate foreign investment.

At Wavteq, our global LG teams have had to become more fluid and adapt to the ebbs and flows of what seems to be working best when it comes to engaging with companies and attracting their interest to the regions of our clients. One of the keys to this? Embracing virtual technologies.

Below are several ways that Wavteq’s LG teams have utilised virtual technologies throughout the last two years:

Even before the pandemic struck, experts outlined the potential for significant growth in the VR/AR industry. A 2019 report from PwC indicated that this growth could add over £1.4 trillion to the global economy by 2030. Whilst the majority of this growth will be across sectors such as entertainment, health care, military and retail, IPA’s can be one of the biggest beneficiaries of the utilisation of this tech.

With slow recovery forecast for 2022, and the Ukraine-Russia situation only exacerbating this, VR/AR can be the perfect solution for FDI, removing the need for significant travel and speeding up an otherwise lengthy negotiation process that traditionally includes copious phone calls.

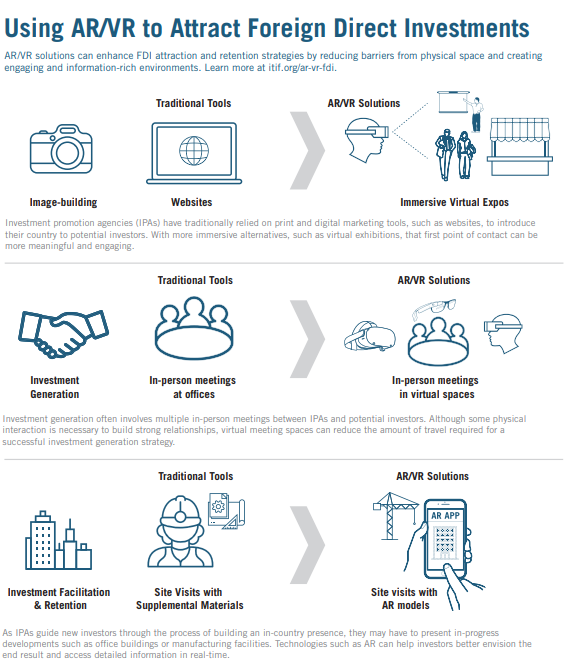

It doesn’t take much thought to understand the potential applications of VR/AR for IPA’s. For example:

• Webinars that have been so widely used in the industry over the last two years could be replaced by virtual events taking place in digital replicas of real locations.

• Traditional PDF marketing materials could be replaced by immersive and interactive versions.

• VR/AR could be integrated into targeted outreach strategies.

• Site visits and location scouting can be done virtually and not incur the costs of flights and hotels etc.

Obviously, the applications of this tech are more numerous than what has just been mentioned, however it clearly outlines the potential that harnessing VR/AR provides. Furthermore, with many government investment policies increasingly driven by sustainability and going green the replacement of in person site visits with virtual visits is a step in the right direction.

The downside to VR/AR is the cost of implementing such technologies with there being an initial outlay for VR headsets (a pair of Oculus VR goggles will set you back £299) and then additional costs for creation of the materials and videos. However, it must be factored in that the IPA will be saving money hosting the investor as often as the traditional investment attraction process would require. In addition to this, by embracing the technology, IPA’s provide themselves with a better chance of attracting more FDI to their region thus offsetting the initial investment.

Naturally, the U.S. are one of the frontrunners when it comes to VR/AR. Already, 78% of Americans are familiar with the technology and encounter it in both their professional and private lives. As a result, IPA’s in North America are some of the early adopters when it comes to applying this technology to FDI.

At Wavteq, one of our clients has launched an LG campaign solely focused on pushing leads through the pipeline to the site visit stage which will then be undertaken via VR goggles. This project has already garnered a lot of interest from potential investors in a short time frame.

As IPA’s it is important to evolve as the industry evolves. Wavteq Institute can help with this and keep your LG teams updated with the latest industries trends to attract investment. However, it is clear that IPA’S should be on the lookout for VR/AR talent that can help implement this technology within their FDI process and, if marketing is outsourced, marketing companies that can help create immersive materials to drive your FDI numbers up across the board.

Immersive technologies can enhance key investment promotion agency (IPA) activities—image-building, investment generation, investment facilitation and retention, and policy advocacy—as well as broader public sector innovation.