Thank you everyone who joined us for our first training workshop in New York City on "Accelerating Investment Attraction in 2022" hosted by New York City Economic Development Corporation (NYCEDC), in partnership with Financial Times and Foreign Trade Commissioners Association in New York (FTCA).

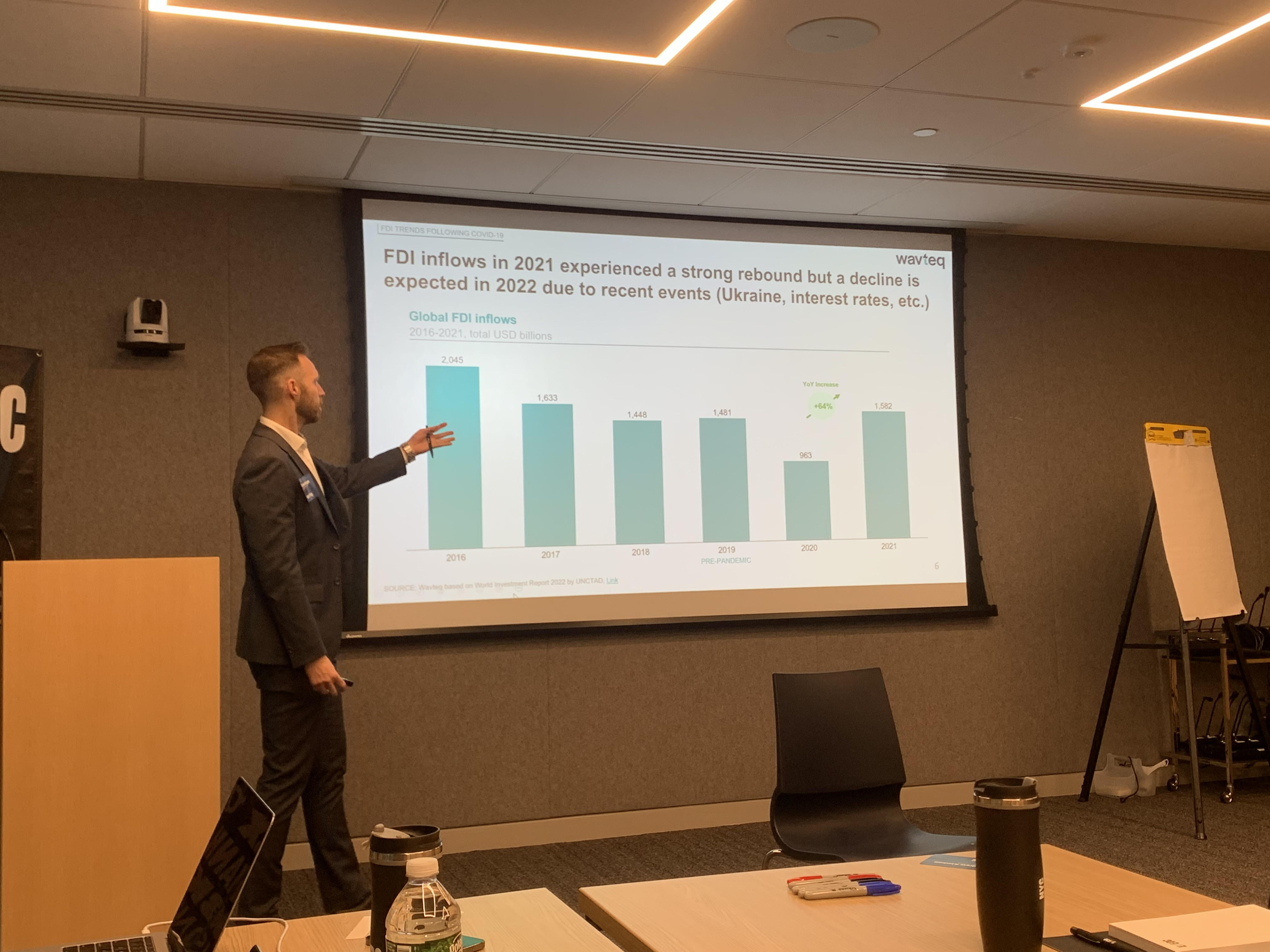

It is safe to say our first physical workshop since Covid-19 was a resounding success. In the session, expert speakers Chris Knight (CCO, Wavteq) and Guillermo Mazier (President, Americas, Wavteq) focused on ways economic developers can attract corporate investment to FDI to their location, along with an overview of current corporate investment trends affecting investment attraction in 2022.

For those that missed the session, we have summarised the key takeaways below!

Market dynamics refer to the forces that impact the decisions and the behaviours of our internal and external marketing efforts. These forces provide economic development and investment promotion leaders an opportunity to rethink their traditional strategies. A recent McKinsey Survey suggested that the majority of key industry sectors experienced material disruptions lasting a month or longer every 3.7 years on average with shorter disruptions happening even more frequently.

What economic developers should consider: Focus your marketing strategies and efforts around risk reduction and location resiliency.

It is becoming clear that the global race to net zero is beginning to shape investment decisions. This race has turned ESG into one of the most important drivers of FDI in the post Covid world. According to survey findings in the 2022 Global IPA Perception Study, nearly 64% of IPA respondents assess the Environmental, Social and Corporate governance (ESG) impact of the investment proposals that they receive. Additionally, around 70% of the survey respondents identify investment sustainability as a ‘very strong’ or a ‘strong focus’ area. However, only 22% of FDI in developing and transition economies have been invested in SDG related sectors and ~10% in advanced economies between 2010 and 2019.

What economic developers should consider: Marketing strategies and efforts to promote, greener exports and sustainable investments opportunities which may be viewed as a strategic advantage.

“There are an estimated 15,000 economic development/investment promotion organizations globally vying for an estimated 14,000 projects annually.” - Guillermo Mazier

Proactive lead generation can have a major impact on both the volume and quality of FDI attracted. By proactively reaching out to potential investors, good quality business leads can be generated which would not have considered the location (70% of investors only contact an EDO/IPA after they have been shortlisted or not at all!).

What economic developers should consider: develop a lead generation strategy which focuses on your location's strengths and opportunities.

Most investment promotion websites are geared towards promoting location features and advantages for investors in specifically targeted sectors. This typically includes information on the labour market, operating costs, incentives, infrastructure, business climate, existing investors, industry trends and other information. While this traditional approach is essential to promote a location for “mobile” investments which are assessing different location options for their greenfield investment project, many countries are now also promoting Investment Projects Ready to Offer (IPROs) in their location. These can take the form of Shovel Ready sites ready for investors to move into, infrastructure projects which foreign investors can bid for, or local companies who are seeking a Joint Venture.

What economic developers should consider: Very few investment agencies are presenting well packaged IPROs on their website ready for investors to assess the investment project opportunity.

Cultural intelligence (CQ) has been conceptualized as an individual’s capability to function and manage effectively in cross-cultural contexts, and it constitutes a type of intelligence which is different from cognitive, emotional, or social intelligence. It is becoming increasingly important in a globalized world.

Doing Business Development across cultures is about using cultural insights and being adaptive in how you approach the sales process. When you’re focused on a particular market, the nuances of tone are crucial for each country.

The tone that works in the U.K. (frank and sometimes humorous) isn’t always going to be the same for outreach to Germany (polite and polished). Cultural understanding, language barriers, fluency and values all play a critical role in your outreach process.

What economic developers should consider: tailored approach to communication with investors and stakeholders across different cultures. Hiring team members with cultural intelligence, foreign language skills and global exposure helps.