Sanduni is a legal scholar, with a passion for FDI research and facilitation. She joined Wavteq’s North America team one year ago, as an FDI Lead Generation Specialist. During the past year, Sanduni worked with around 15 EDOs from the Americas, Europe, Africa, and the Middle East, in various FDI lead generation projects, proving her calibre in identifying the firms that can thrive in the respective regions, pitching the regions as FDI destinations, organizing roadshows, etc. From the African region, she worked with EDOs from Nigeria, Liberia, and Tunisia, identifying potential investors from USA and Canada.

What are FDI Drivers?

FDI drivers are the reasons that can induce a firm to consider international expansion. Broadly, economic theories identify factors such as finding new markets, obtaining natural resources, accessing a labour force, or improving efficiency, as the key FDI Drivers. In addition, the literature has identified labour costs, market access, trade openness, and tax incentives as the main determinants of a firm’s choice to expand to a new geographical location.

From a perspective of a commercial firm (the investor), it is an arduous decision to consider international expansion, involving capital, time, and human resources. The decision can also have an impact on the company’s profits, productivity, and reputation. Most companies look for a balance between cost, quality, and profitability.

FDI inflows to Emerging Countries

It was heartening to see that global FDI flows recovered to pre-pandemic levels in the past two years. As per UNCTAD’s world investment report for 2022, global Foreign Direct Investment (FDI) flows in 2021 were $1.58 trillion, up 64 percent from the exceptionally low level in 2020. However, the same report points out that FDI flows to emerging countries as a group over the past decade has increased only marginally.

More than any part of the world, emerging countries, need capital to transform their economies, especially due to the exceeding reliance on imports. However, the latest FDI statistics show that emerging countries depend on external sources for finance such as official development assistance and remittances. Therefore, the economic development officials and policymakers in the emerging countries need to make robust efforts to attract the much-needed capital for their countries.

Value of Investor Feedback

An important consideration that EDOs (Economic Development Organisation) should bear in mind is that FDI drivers will vary according to geographical location, sector, time, and many more external factors. Therefore, EDOs must see though the lens of the investing company’s decision-makers when developing the country’s pitch as an FDI destination. The first step in developing the host country’s pitch is to understand what the investing firms are seeking. The region-specific or country-specific market feedback is one of the best sources of understanding the investing firms’ mindset.

In the below commentary, I hope to bring under the spotlight the key factors that make Africa attractive for American Firms in the post-pandemic era. This analysis is based on the discussions with the decision-makers of hundreds of US and Canadian firms considering international expansion in the past year. I do hope that this commentary comes in handy in the hands of EDOs in many African countries, in their efforts to attract FDI from North America.

Types of FDI Opportunities that North American firms like to explore

In 2022, we noticed a significant interest from North American Firms in the food and beverage sector to obtain raw materials from Africa. These types of firms can generate immediate economic benefits for the host country, especially when compared to a firm that seeks to enter a new market. In the latter case, it is the large domestic and export markets that lure agricultural companies to a new location. They tend to enter new markets through trade and will set up a physical presence and commence exports only after identifying good market traction from a region, which may take years. In contrast, the hunt for raw materials lures the firms to set up a presence in the host country and start exporting in a relatively shorter period. Integrating into the supply chains can benefit the host country’s economy in multiple ways, including generating economic activities in infrastructure, transport, and commercial sectors.

One American food company specifically commented that consumers are now concerned about the ingredients as much as the final product, and therefore the company seeks to make a high-quality investment to ensure the quality of raw materials at every stage of production purpose. Africa is resourceful in food crops such as coffee beans, rice, cassava, peppers, plantains, peanuts, etc. It is no doubt that African EDOs can showcase many opportunities in this sector, for investors to explore.

In a global context, new markets are the most prominent FDI driver. However, due to the low purchasing power of the populations in the emerging countries and the lack of export infrastructure, emerging countries are not a popular destination for firms seeking new markets. Therefore, it is noteworthy that North American firms in certain sectors, showed much interest in exploring the emerging countries markets due to the specific needs of these countries.

Agriculture is one such sector, given that most emerging countries depend on agricultural imports to fulfill the essential nutritional requirements of the populations. Firms in the fields of food processing, rice cultivation, and shrimp farming showed a willingness to bring production closer to the end consumers. These firms can open many doors for emerging countries in the medium and long term, by export generation, as these companies seek to identify a larger market.

In addition to agricultural products, AgTech firms also showed noticeable interest in exploring the market traction in the African region. In addition to long-term benefits, these companies can benefit the host country's economy in the short term through technology transfer.

Agricultural companies commonly expressed apprehension over the possibility of public protests from domestic producers, or the risks of getting their payments. In this respect, EDOs have an important role to play to support these firms to navigate through local industries and practices. They can share information on measures put in place to mitigate financial risks, such as credit lines available to farmers.

In Africa, there is a lot of untapped potential for infrastructure development. Therefore, many firms in sectors like oil and gas infrastructure, and energy, showed special interest only in the African region. Moreover, the interests of different firms showed opportunities for building symbiotic relationships. For instance, an energy generation project identified the availability of LNG/LPG as an asset, while a few firms specializing in LNG/LPG infrastructure and storage were also interested in investing in new projects in Africa.

Through a well-rounded plan to support these infrastructure projects, emerging countries can generate significant economic development. Infrastructure projects are highly beneficial for an economy as they accelerate economic development in all sectors. Also, these projects can create export opportunities such as exporting natural gas or energy to regional markets.

Market size is an important determinant of FDI inflows. Therefore, attracting FDI has proved a challenge for many African LDCs with a small population and low purchasing power. Therefore, these countries need to enhance the market access domestic producers.

Certain North American firms expressed that they have tried to enter large and emerging African markets but have been taken aback due to reasons such as governmental policies protecting domestic producers, red tape, and bureaucracy. Rather than placing a production facility in Africa, many firms currently rely on having a distribution network for such markets. Some of these companies showed interest in conducting exports to larger African markets from a centralized location in the region, placed in a more welcoming host country.

African emerging countries have preferential access to the larger markets in the region. Therefore, the EDOs should make an extra effort to educate the investors on the opportunities for preferential access to larger markets through domestic value addition. The domestic value addition for exports gains more significance, especially in the context of the African Continental Free Trade Area (AfCFTA), Which came into force in January 2021. AfCFTA promises deeper levels of trade liberalization and enhanced regulatory harmonization and coordination within Africa.

In the past, North American Investments in Africa were made mainly for natural resource extraction. However, the latest feedback reveals that firms in different sectors such as agriculture, manufacturing, energy, and infrastructure, were interested in investing in Africa. The evidence fortifies how emerging countries can benefit from diversifying economies.

Also, in the long run, countries can build a reputation for their expertise in specific sectors. For example, our outreach focused on Tunisia showed how the country thrives in the Aerospace sector, despite the country’s political setbacks, by dint of the industrial expertise built over the years. The emerging countries can also draw inspiration from many such success stories of economic diversification from other African countries such as Morocco, Rwanda, Kenya, and Egypt.

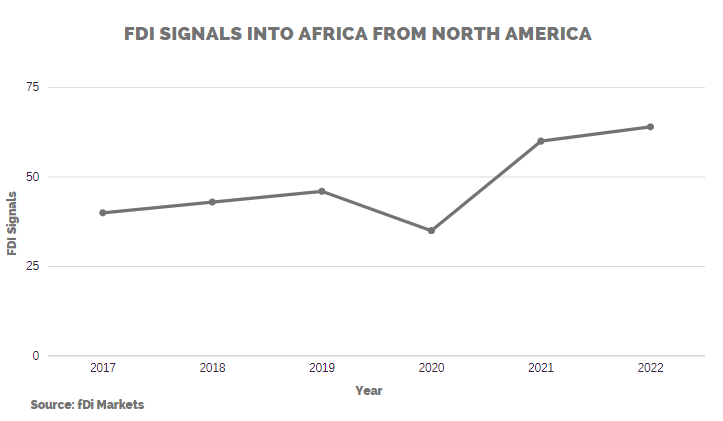

According to fDi Markets, investors signalling interest in Africa from North America has been on the increase in recent years. A record 64 companies in 2022 announced intent to expand into Africa, in most cases after they raised funding. This recorded increase can't be ignored and is something economic development officials in Africa should be focusing on through their lead generation outreach.

Risks that firms were concerned about

While the firms advocated these opportunities, they were also concerned about the possible risks involved. Firms generally expressed apprehension over macroeconomic instability, inflation, and balance of payments deficits, leading to financial controls. Also, firms were concerned over the possible public outcries that could lead to more protective measures for domestic producers and less favourable conditions for foreign producers. Also, many firms opined that they have a preference for a country with political stability. Further, many firms commented that the country's regulations and ease of doing business were a priority when considering expanding to a new location. Firms also opted to for having a local partner first to mitigate the possible risks associated with local regulations.

How African EDOs can benefit from market feedback:

As per the current FDI statistics, North America as a source of FDI for Africa is relatively low, compared to Europe and Asia. Therefore, the enthusiasm that the North American firms showed in exploring Africa is very welcoming news. Therefore, if the EDOs can tailor their promotional campaigns and investor support programs to the expectations of the investing firms, it will be highly beneficial for both the firms and the host country.

EDOs should help the investors to analyse and overcome the risks involved in expanding to the respective region. As a first step, they can illustrate the opportunities, the country’s appetite for hosting the project, and the support available, using visual data. After identifying the initial interest of the investor, it is highly important to extend customized and readily available support to the development and implementation of the intended project.

At the same time, wherever possible, the EDOs should advocate measures for economic and financial stability, at the higher levels of policymaking. The experience in many parts of the world shows that adopting domestic policies consistent with open markets and financial and trade liberalization, has proved to be highly conducive to FDI promotion.

In conclusion, The FDI drivers that worked elsewhere may not make the same effect in Africa or the African emerging countries, because firms see different opportunities in each region. This will be a window of opportunity for emerging countries if they can rightly identify the opportunities that they can harness.

Whether you need full in-market sales representation, support with specific trade shows, investment missions, and seminars or simply need to bolster your pipeline of trade and investment leads we can meet your needs.